Whaler Publishing Company

Week 4 Case Study

Read the case on Whaler Publishing Company and answer the following questions.

Case Study Questions:

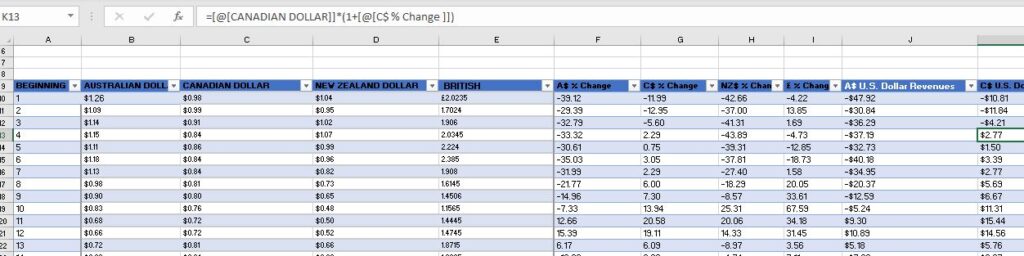

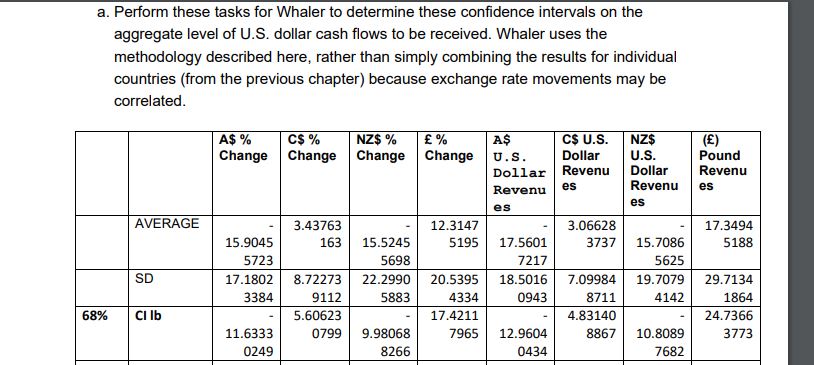

- Perform these tasks for Whaler to determine these confidence intervals on the aggregate level of U.S. dollar

cash flows to be received. Whaler uses the methodology described here, rather than simply combining the

results for individual countries (from the previous chapter) because exchange rate movements may be

correlated. - Review the annual percentage changes in the four exchange rates. Do they appear to be positively

correlated? Estimate the correlation coefficient between exchange rate movements with either a calculator or

a spreadsheet package. Based on this analysis, you can fill out the following correlation coefficient matrix.

A$ C$ NZ$ £

A$ 1.00 — — —

C$ 1.00 — —

NZ$ 1.00 —

£ 1.00 - Would the aggregate dollar cash flows to be received by Whaler in this case be riskier than if the exchange

rate movements were completely independent? Explain. - One Whaler executive has suggested that a more efficient way of deriving the confidence intervals would be

to use the exchange rates instead of the percentage changes as the scenarios, and to derive U.S. dollar

cash flow estimates directly from them. Do you think this method would be as accurate as the method now

used by Whaler? Explain.

Answer preview for Whaler Publishing Company

APA

1234 Words