Time Value Money in Everyday Life

Overview:

This assignment will give you the opportunity to apply what you have learned about Time Value Money to everday life. In this instance, calculating a mortage’s monthy

payment and principle.

Instructions:

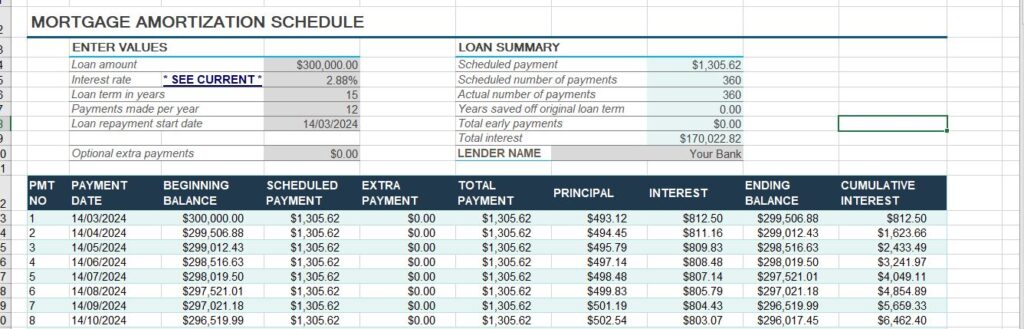

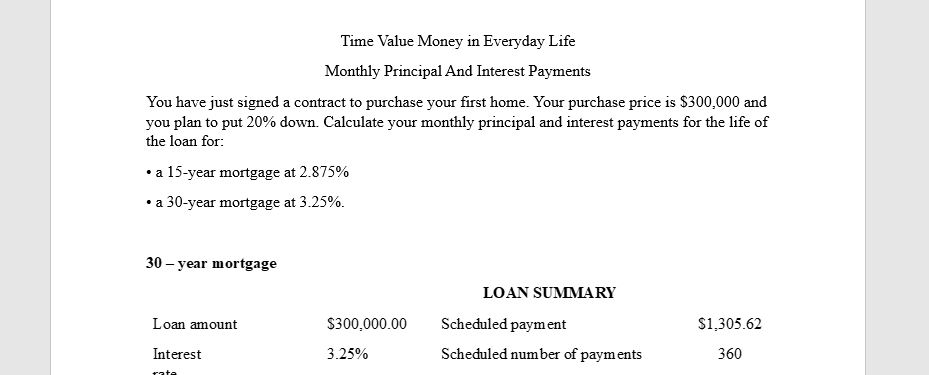

Congratulations! You have just signed a contract to purchase your first home. Your purchase price is $300,000 and you plan to put 20% down. Calculate your monthly principal and interest payments for the life of the loan for:

- a 15-year mortgage at 2.875%

- a 30-year mortgage at 3.25%.

Compare and contrast these two options. - What are the Pros and Cons of each?

- Would a rising rate environment impact your decision on which to choose?

Why? - How about an environment where rates are decreasing? Would there be a better

option?

Requirements:

- Submit in a Word document or Excel spreadsheet.

- At least 2 pages in length.

Answer preview for Time Value Money in Everyday Life

APA

900 Words